Smarter Insurance powered by Location Intelligence

Real-Time Management Powered by Location

Insurance companies aren’t just in the business of covering accidents—they’re in the business of preventing them. That’s where Fluid Mobility comes in. We provide insurance organizations with the ability to collect data from connected devices to better assess risk and more accurately tailor insurance policies to customers.

Our GPS-powered mobile solution helps insurers reduce distracted driving, lower claims, and enhance risk assessment—all while keeping policyholders safe and engaged. Fewer distractions mean fewer accidents, and fewer accidents mean happier customers (and underwriters).

Add content here

ADD CONTENT HERE

Drive Safe, Save Big: How Fluid Mobility Helps Insurers Win

Insurance isn’t just about reacting when something goes wrong — it’s about helping prevent the “oops” moments before they ever happen. That’s where Fluid Mobility comes in. We give insurance providers real-time data, smarter insights, and tools to reduce distracted driving, lower claims, and keep policyholders safer (and happier).

More safety, fewer claims, stronger customer loyalty — what’s not to love?

Let’s be honest: most drivers know texting at a red light isn’t great… but some do it anyway. Fluid helps nip that in the bud by turning phones into safety partners.

- Block the Distractions: Automatically lock social media, texts, and video apps while the car’s in motion..

- Smart Nudges: Send helpful messages to encourage good habits and reduce risky behavior.

- Fewer Accidents: Less screen time behind the wheel = fewer claims on your desk.

The Result: Safer drivers, fewer payouts, and reduced risk across your portfolio. Total win.

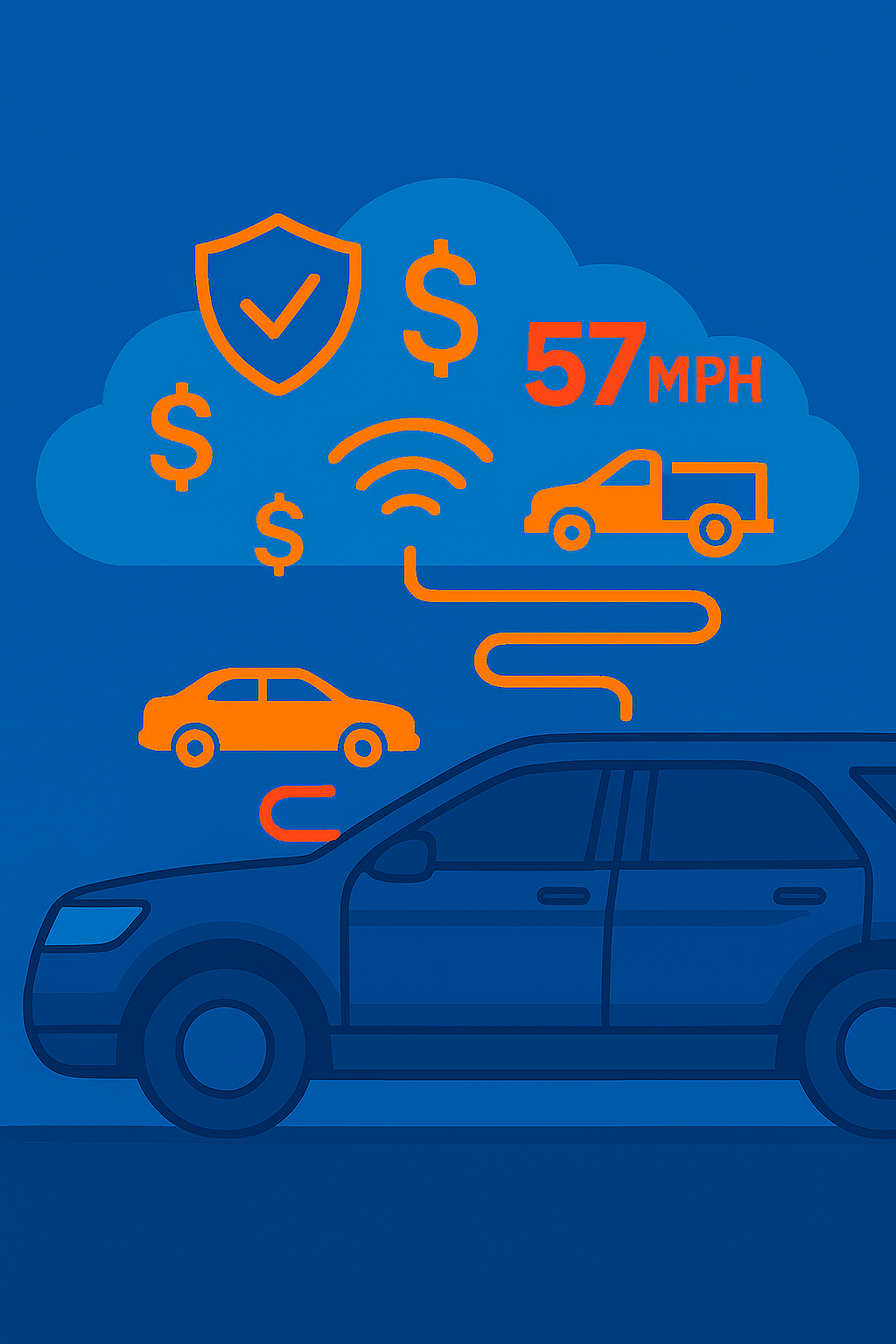

Why treat every driver the same when you’ve got the data to tell who’s careful — and who’s cruising with one hand and a latte? Fluid gives you the tools to personalize policies based on real behavior.

- Predictive Maintenance: Spot vehicle wear-and-tear issues before they turn into breakdowns or claims.

- Usage Based Insurance (UBI): Integrate real-time data into your UBI programs to better assess risk.

- Behavior-based Pricing: Use location, mileage, time of day, and more to tailor premiums to how people drive.

The Result: Happier, safer drivers paying rates that make sense — and fewer surprises in your claims data.

Claims that don’t quite add up? We’ve got the data to back you up. With GPS-verified info and timestamped insights, Fluid helps you sniff out false claims and tighten your processes.

- Lower Claim Payouts: Fewer accidents mean less cash going out.

- Spot the Red Flags: Use data to pinpoint inconsistencies or signs of driver error.

- Incident Verification: Confirm exactly where and when something happened — and whether it checks out.

- Streamlined Admin: Save your team hours with automated tracking and reporting.

The Result: Fewer bogus claims. Lower losses. A stronger bottom line.

If your clients manage corporate fleets, you know they’re juggling safety, compliance, and liability. Fluid makes it easier to check all those boxes — and then some.

- Keep Drivers Focused: Block distracting apps on company devices automatically.

- Meet Compliance Goals: Monitor driver behavior and log safety metrics with ease.

- Reduce Legal Risks: Safer driving = fewer accidents = less chance of costly lawsuits.

The Result: Lower costs, better care, and a facility that practically runs itself (okay, almost).

Let’s be real — insurance isn't always exciting. But when drivers can see how their actions impact their rates, they actually get into it. Fluid helps you build stronger relationships through transparency and real-time feedback.

- Safe Driving Rewards: Offer discounts or perks for good driving habits.

- Live Driving Feedback: Let users track their own behavior and risk scores — instantly.

- Build Trust: A proactive approach shows you’re not just there when things go wrong — you're helping them get it right.

The Result: More loyal customers, better engagement, and fewer complaints. That’s what we call retention done right.

Add content here

ADD CONTENT HERE

Featured posts

Platform Highlight:

Mobile Device Security: Driving Compliance

Insurance is all about trust, and that starts with keeping data safe. With Fluid’s mobile device management (MDM) tools, you can easily set up smart security rules — like passcodes, app restrictions, and encryption — to protect sensitive customer info wherever it lives.

Better yet, Fluid helps you stay on top of data privacy laws and compliance requirements, so you can focus on serving clients, not sweating the small print.